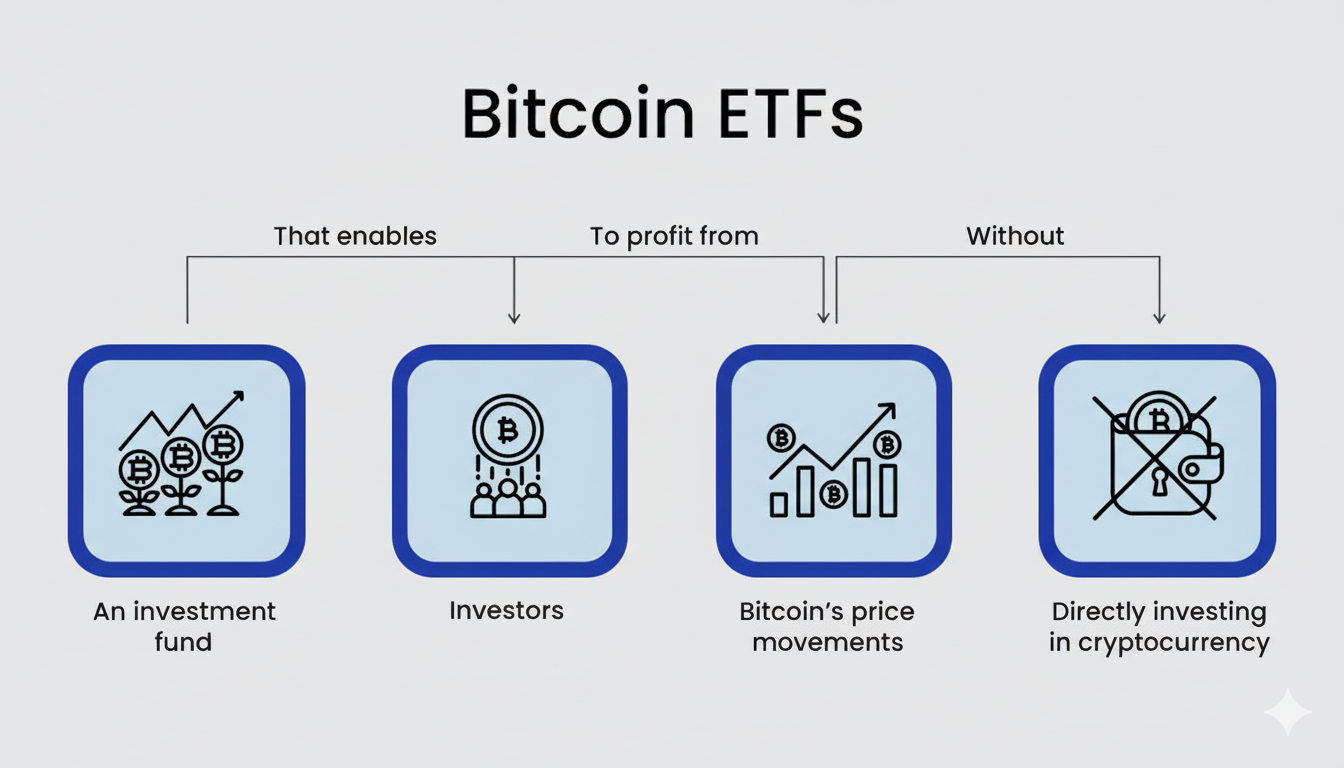

A Bitcoin ETF (Exchange-Traded Fund) is a regulated investment product that mirrors the price movement of Bitcoin while trading on traditional stock exchanges such as the NYSE or Nasdaq. It enables investors to gain exposure to Bitcoin’s performance without directly buying or managing the cryptocurrency.

How Bitcoin ETFs Work

ETFs are financial instruments that track the value of an underlying asset or index. A Bitcoin ETF operates the same way; each share reflects Bitcoin’s market price. When Bitcoin rises, the ETF’s value increases, and when it falls, the ETF declines. Unlike purchasing Bitcoin from a crypto exchange, investors can buy ETF shares through regular brokerage accounts, simplifying access to the asset.

Advantages of Bitcoin ETFs

Convenience: Investors gain Bitcoin exposure without needing digital wallets or private keys. The fund holds Bitcoin securely with regulated custodians, reducing storage risks.

Diversification: Some ETFs include Bitcoin alongside equities or commodities, allowing investors to balance their portfolios across asset classes.

Tax efficiency: Because these ETFs are regulated, they typically meet the requirements of institutional investors and are eligible for tax-advantaged accounts.

Disadvantages of Bitcoin ETFs

Fees: ETFs charge annual management fees that can reduce long-term returns.

Tracking variance: A Bitcoin ETF may not perfectly match Bitcoin’s price, especially if it holds other assets.

No direct ownership: Investors don’t control or use the Bitcoin held by the fund, missing out on features like self-custody or crypto-to-crypto trading.

Spot, Futures-Based, and Leveraged Bitcoin ETFs

There are three main types of Bitcoin ETFs: spot, futures-based, and leveraged.

Spot ETFs hold real Bitcoin in secure cold wallets managed by custodians, providing direct exposure to the asset’s market price without requiring investors to buy or store crypto themselves.

Futures-based ETFs invest in derivatives that speculate on Bitcoin’s future price, which can introduce higher costs and tracking differences compared to the spot market.

Leveraged Bitcoin ETFs aim to amplify Bitcoin’s daily returns—often 2x or 3x—using financial leverage. While they can boost gains, they also magnify losses and are best suited for short-term traders rather than long-term investors.

Overall, spot ETFs offer the most accurate price exposure, while futures and leveraged ETFs carry higher complexity and risk, requiring careful consideration by investors.

Growth and Adoption

Since their SEC approval in January 2024, spot Bitcoin ETFs have attracted significant demand. Cumulative U.S. inflows have surpassed $62 billion, with total ETF assets estimated between $165–170 billion, or roughly 7% of Bitcoin’s market cap.

- BlackRock’s IBIT leads with over 800,000 BTC under management.

- Fidelity’s FBTC and ARK 21Shares’ ARKB are expanding rapidly, with ARKB offering the lowest fee at 0.21%.

- Grayscale’s GBTC remains large but has seen outflows due to its higher 1.50% management cost.

Global Expansion

Beyond the U.S., spot Bitcoin ETFs are gaining traction worldwide:

- Canada: Among the earliest adopters, now hosting six ETFs with $2.79 billion in assets.

- Germany: Two ETFs totaling $1.13 billion trade on the Xetra exchange.

- Hong Kong: Launched four spot ETFs in 2024 with strong institutional participation.

- Europe: Hosts numerous ETPs and ETNs from issuers like 21Shares, CoinShares, and WisdomTree.

Regulatory clarity in these regions has driven greater institutional and retail adoption.

ETF Flows and Market Sentiment

Bitcoin ETF flows, measured by daily inflows and outflows, are a useful gauge of investor confidence. Positive flows suggest accumulation, while outflows often indicate caution or profit-taking.

In October 2025, U.S. spot Bitcoin ETFs recorded a $1.2 billion single-day inflow, one of the largest on record, helping drive Bitcoin to a new all-time high above $126,000.

How Spot Bitcoin ETFs Function

Spot Bitcoin ETFs purchase and hold Bitcoin directly, secured in cold storage by licensed custodians. The fund issues shares that investors can buy or sell on regulated exchanges, with market makers ensuring liquidity.

- Shares move in line with Bitcoin’s price

- Traded on exchanges like NYSE and Nasdaq

- Expense ratios range between 0.21%–1.50%

- Leading funds include IBIT, FBTC, ARKB, and GBTC

Pros and Cons of Investing in Bitcoin ETFs

Benefits:

- Simple access via traditional brokerage accounts

- No need to handle private keys or wallets

- Institutional-grade security and oversight

Drawbacks:

- Subject to Bitcoin’s volatility

- Ongoing management fees reduce profits

- Cannot be used for staking or DeFi activities

- Investors do not directly own the Bitcoin held

Bridging Crypto and Traditional Finance

Spot Bitcoin ETFs have become a major gateway between traditional finance and the crypto market. They simplify exposure, enhance accessibility, and promote regulatory compliance, making Bitcoin more approachable for both retail and institutional investors.

However, ETFs trade convenience for control. They do not grant the autonomy or privacy benefits of holding Bitcoin directly. As the ecosystem evolves, spot Bitcoin ETFs are likely to remain central to Bitcoin’s integration into global financial markets, serving as a regulated bridge between digital assets and traditional investing.